Get Started With

servzone

Overview

It is well said that directors are the brain of the company. They are managerial employees who control and administer the company's services. The revolution of directors takes place in one or another way – either by the selection of new director or withdrawal of existing. Endeavor to carry out the change of directors is always to guarantee an optimum blend of experts on board for the interest of the company.Authorization to approve the director's resignation rests with BoD's portions, while the appointment must be made through the consent of shareholders. Whether it is appointment, expulsion or resignation, the change does not make a consistent impact; Intimation is made up of 'Ministry of Corporate Affairs'.

Eligibility criteria

There is no specified qualification, but a person must be a director with the following mentors:

However, according to the law, a specific natural person only can be a director of any company.

- Age Limit

There is no alternate age set for being a director, but it is necessary that the person who is competent to enter into any contract should be. Further, in the case of 'Managing Director', 'Full Time' Director, or 'Independent' Director of a recognized company, the person becomes eligible to become a director when he is 21 and does not reach the age of 70 years. Years officially.

- Determination of nationality

There is no restriction. However, the company should have a minimum of one Indian director.

- Requires DIN

To be eligible to be named as a director of the company, the person must obtain a director identification number. The main motive behind being a DIN is to ensure that fake directors do not commit any fraud, and if anyone initiates any such criminal activity, they can be traced within this unique number.

- Valid specification limit

A personality can only be a director of 20 different companies at once. Out of these 20 companies, only ten can be public companies.

Ineligibility

- Un minded or insolvent person

No one, who is mindless or unable to take decisions on his own, cannot be appointed as a director. It consists of frames with children, mentally disabled persons and unstable mental faculties. In addition, insolvent people or individuals who maintain bankruptcy claims in a court of law are disqualified from acting directors.

- Criminal Background

If a personality has a criminal record and is sentenced to imprisonment of seven years or more, he can be a director.

- Pending overdue returns

If a person has not filled previous returns in prior years, he will be barred from holding the position of direction.

Types of director

The directors of a company change in terms of their role, such as the managing director who drives the overall objectives of the company, the executive director who looks after the day-to-day methods, and the independent director who oversees the proper administration. Give assurance company. Which can increase the directors of a company; However, the appointment of directors also depends on the type of business such as:

- According to 'Section 149 (1)' of the Companies Act, 2013, every public corporation shall have a minimum of 3 directors, whereas in a private company the minimum amount of directors is in the case of two and only one director. 'One Person Company.'

- The highest number of directors in a public company is 15.. In addition, a company may also select more than 15 directors after obtaining a permit from a specific resolution at a general meeting. The manner of appointing more directors does not expect the support of the central government.

- A director may set the number of directors up to a maximum of 20, including any optional direction of a person.

- In the event of any private company or 'public company,' either holding or subsidiary company shall restrict to10 directorships in the 'public company'.

- All the Certified companies must appoint at least one woman director in the Board of Directors in a year from the enforcement of the second Proviso to Section 149(1) of Companies Act.

- Similarly, each public company owns Rs. 300 crores paid share capital or Rs. One hundred crore rupees under the latest audited financial statements shall appoint at least one female director within one year from the convocation of section 149 (1) of the second provision of the Companies Act.

Note: "If any person holds the efficiency of director in more than 10 or 20 companies before the commencement of Companies Act, then he shall have to determine the companies where he wishes to maintain or resign as the director within one year from such beginning. After that, he shall inform about his decision to the chosen companies as well as the concerned Registrar.

Appointment and Resignation of Directors

Section 168 of Companies Act, 2013, implements a clear picture of the appointment and resignation of directors, which wasn’t satisfied previously in the Companies Act, 1956. Since a business does not have a physical presence, it gets identified as an artificial person to whom only a natural person can bring into life. Consequently, a person who takes charge of managing the company’s operations is known as the director. Different directors are qualified for handling various aspects of the company.

Resignation of the Director under Section 168

- Any director can resign from his office by furnishing written notice to the company. After collecting such notice, the Board shall take note of the same, and the corporation shall intimate the Registrar in such a manner, time, and form as designated. Provided that-

- The company shall place the case of such resignation in a report of directors shortly after the general gathering of the company.

- The director shall also intimate and forward a copy of his resignation along with a precise reason for his resignation to the Registrar within 30 days of resignation.

- The resignation of a director should take its influence from the date on which the company accepted his notice or from the itemized period mentioned by the director in mind, whichever comes later: Provided- that the director who has resigned should be liable for the offenses which appeared during his tenure even after the resignation.

- Whenever all the directors of a company resign at the same time, the promoter or the central government will select the requisite directors, during which the old directors are to hold the company until the new nominee is held by the company in the general meeting. Do not happen. .

Understanding of directors resignation

- Dispute with the board

When many directors usually work, a situation of differences can occur. This impedes the overall performance of the corporation; In such a situation, the director may decide to resign.

- Opening a more profitable career

Everyone seeks a more satisfying career opportunity to enlarge their domain, and selects an option that encourages their inner aspirant. Similarly, directors may resign if they receive a better opportunity or some enterprise in which they are selected as directors by the AOA.

- Abuse in company matters

When a director becomes acquainted with the company's illegal practices, he may find himself dragged into a case that matches the reason for his resignation. To defend himself from the personal liability that comes out of such activities, he chooses to resign.

- Suspension due to infringement

Any non-adherence, violation, or defaults on the director’s end can lead him into trouble.

- The recession of nomination

It is only appropriate to the Nominee directors who primarily get appointed by the NBFC’s investors on the BOD. Once the transaction between the company and entity is complete, the Nominee director can resign, or he may also leave after the removal of nomination.

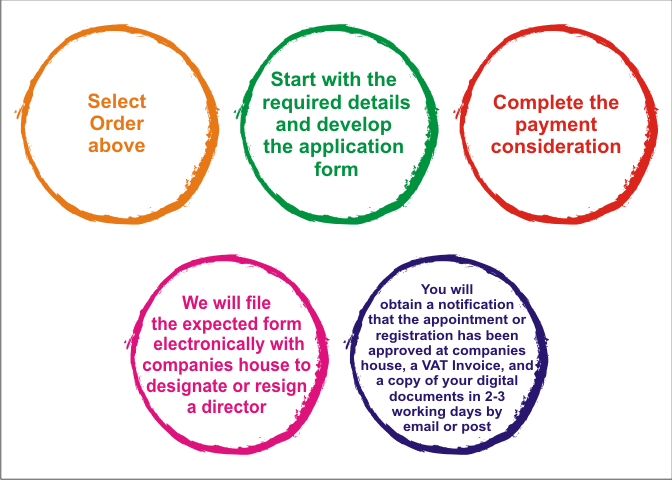

Servone Complete Procedure:

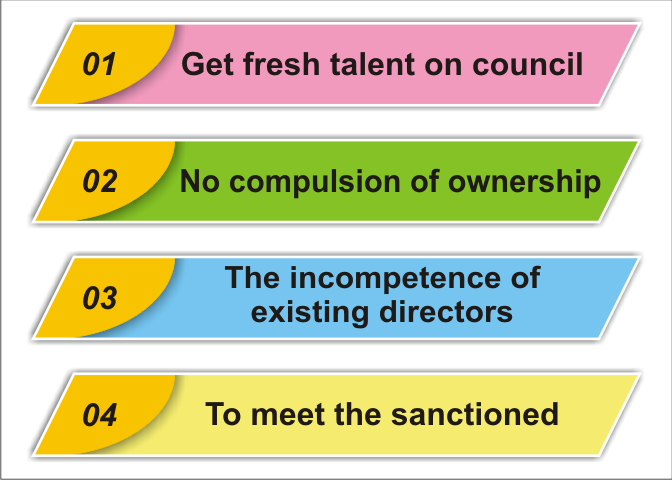

Why Add and Switch?

Required Documents

- Photograph: Passport size photo of the director to be specified

- PAN Card: Self-attested PAN card of the Director to be specified

- Proof of Residence: Aadhar Card / Voter ID / Passport / Driving License to be appointed Director

- Digital Signature Certificate: Termination / removal of DSC of the running director and director

- Identity proof before-mentioned as Passport/Election card/Driving License/Aadhar card

- Mobile number and Personal & official email id of the Director

- It is mandatory to apostille all the documents apostilled if the Director is a non-resident of India.

- Notice of resignation filed with the company

- Proof of dispatch

- Receipt of the form upon receipt.

Resignation of director

Resignation of a Director / Managing Director, Companies act in 2013, claiming that the company has special duties and obligations to fulfill.

- The first and foremost option is to pass a joint resolution to the company to authorize the notice or letter of resignation and commission Form DIR11 to define the reasons behind the departure, referred to in section 168 (1) As per the provision. The Companies Act, 2013.

- According to 'Rule of16 of Companies Rule, 2014 (Appointment and Qualification of Directors)', the resignation report or notice and views for resignation should be shared with the Registrar of Companies (ROC): Rule Form DIR 11 '. Using, within '30 days' of the date of removal.

- To file eForm 'DIR11', the company must provide a notice or letter of resignation. This is the plan for the company through the resignation of the Managing Director; The companies operate in 2013.

- Documents to be submitted are:

Notice of resignation filed with the company

proof of transmission

Receipt of form upon receipt of.

Appointment of Director

Director Appointments

during incorporation

- Appointment of first directors

At the age of company registration with MCA, individuals who fit as directors are the first directors of the company. However, during incorporation, if the previously mentioned directors are not, the parent customers of the MOA will automatically display the directors of the company.

- Necessary: ​​How to do?

MCA has announced a new process to set up the company. There is no pre-requisite to have a DIN-Director Identification Number to become a Director at the time of establishment. DIN is the allocation place at the time of nomination of the company. In addition, it is important to present the details of directors by MCA in e-form. Director's 'master data' will be available on the MCA portal after the establishment of the company. At the event of the appointment of directors, the firm should possess the following Director’s documents attached. In the new form of association, a culmination of 3 DIN can be allotted. So if persons do not have DIN, then a maximum of 3 persons can be elected as directors.

Provisional: Appointment of Director following section 152 of the Companies act 2013

- In the matter of a One Person Company, an individual as a part shall be deemed/considered to be its first director till the member duly appoints the Director (s) according to the provisions of Section 152.

- Section '149(1)' of the Companies Act-2013, demands every Company has the least number of 3 directors in the case of a public company. Moreover, two directors in the case of a private company, and one director in the case of a One Person Company. A public company can select a maximum of 15 fifteen directors. Additionally, a company may choose more than 15 directors after passing a special resolution in customary meetings, and the consent of the Central Government is not required.

- “Any person carrying office as Director in more than 20 or 10 companies as the case may be before the initiation of this Act shall, within one year from such services, have to choose companies where he wishes to continue/resign as Director.

- Each registered company shall select at least one female director on the board of directors within one year from the second provisional initiation to section 149 (1) of the Act. In addition, every other public company has Rs. Is the share capital of. One hundred crore / more or annual turnover of Rs. As on the last date of the latest audited financial statements, the appointment of at least one female director within a year exceeding Rs.300 crore / - will be made by the commencement of the second proviso of section 149 (1) of the Act.

Classes of directors

- Managing Director

They are given full power and duty to operate the company.

- Executive Director

They run day to day for the functioning of the company, which are more responsible and effective for the company.

- Non-Executive Director

They are not into making or conducting day to day decisions.

- Nominee Director

These are not the primary directors, but are chosen by PE / VC investors or banks that have provided loans or shareholders in the case of a certified company to represent their interests.

- Independent Director

He is selected in the company to oversee and ensure sound governance.

appointment of directors

1. Fundamental process

- As per Section 161 (1) of the Companies Act, 2013, if the Director of the Company (AOA) recommends adding the Director, indicate. If not, convert the company's articles in a way to add a company director.

- Save documents and bloom required for process

- Registration of Form DIR-2, Form DIR-12, and Form DIR-8 on ROC must be completed.

- The advertised / proposed director should be allowed to act as a director through Form DIR-2. This is one of the general documents required to add a new director, and therefore, must be obtained before anyone is advised to be a director.

- If the company has to appoint him as a director, then regularize the person as a director in the general meeting by shareholder resolution.

2. Subsequent process

- Call a board meeting.

- The Director should be nominated at a general meeting and taken to ensure that this notice is published following the laws outlined in the Companies Act, 2013, and made by the rules mentioned in the secretarial standards issued by the Institute of Companies Has been the Secretary of India.

- Pass the recommendation / proposal for appointment of supplementary director.

- Issue a 'letter of appointment'.

- The company is required to file Form DIR-12 to the Registrar of Companies within 30 days from the date of appointment.

- The company should make important entries in the register of directors and managerial personnel as necessary.

- Further, the company has to apply for necessary changes in the details of the director in respect of GSTN and other certificates, when and when necessary.

- After this, you will have a new company director's designation on the MCA website.

GST Registration

PVT. LTD. Company

Loan

Insurance